· How-Tos · 7 min read

Square Dog Grooming Software: Why MoeGo Users Are Looking for Alternatives (2026)

MoeGo is pushing groomers toward its proprietary payment system, leaving Square users with limited features. Learn what this means for your business and explore Square-compatible alternatives.

If you built your grooming business on Square, MoeGo’s payment strategy might be quietly pushing you toward the exit.

MoeGo dominates the pet grooming software market. Their scheduling tools are solid, their mobile grooming features are genuinely useful, and their customer support gets consistent praise. But there’s a shift happening that Square-committed groomers need to understand: MoeGo has built a proprietary payment processor called MoeGo Pay, and they’re increasingly steering users away from Square.

This isn’t speculation. Premium features that groomers rely on daily—deposits, card-on-file for no-show protection, pre-authorization holds—are now exclusive to MoeGo Pay users. If you’ve invested in Square hardware and built your financial infrastructure around Square’s ecosystem, this creates a real problem.

Here’s what’s actually happening, what it costs to switch, and what alternatives exist for groomers who want Square dog grooming software that doesn’t force a payment processor change.

What’s Actually Happening with MoeGo and Square

MoeGo launched MoeGo Pay as their “built-in” payment solution. The marketing positions it as seamless and integrated—which it is, if you’re willing to abandon your existing payment infrastructure.

The issue isn’t that MoeGo Pay exists. The issue is what happens if you don’t use it.

Features now exclusive to MoeGo Pay users:

- Card-on-file storage for charging no-show fees

- Prepayment and deposit collection during online booking

- Pre-authorization holds that validate cards before appointments

- Next-day payouts (versus standard 2-3 day processing)

- Business funding and loans based on your processing history

MoeGo’s own documentation states it plainly: “As long as you are using MoeGo Pay as your payment processor, you can enjoy these features as they are MoeGo Pay exclusive.”

Square integration technically still exists within MoeGo. But user reviews tell a consistent story. One Capterra reviewer noted: “The product does not integrate with the Square register unfortunately. My register is only a few years old and I am not about to replace the register with a terminal.”

Another GetApp user described the workaround: “I can take payments directly from the MoeGo screen utilizing the Square app just a couple of tabs on my screen.” Notice the phrasing—utilizing the Square app, not a native integration. This is manual reconciliation, not seamless processing.

MoeGo Pay runs on Stripe infrastructure and pushes users toward MoeGo-branded hardware: the M2 Reader for mobile, the WisePOS E terminal for salons. None of this works with your existing Square Terminal or Register.

The Real Cost of Switching Payment Processors

Groomers don’t choose Square randomly. Square’s ecosystem creates intentional lock-in through hardware investment, stored payment methods, integrated reporting, and connected services. That lock-in works in your favor when everything is connected—and against you when software vendors try to pull you out.

What you’ve already invested in Square:

- Hardware: Square Terminal ($299), Square Register ($799), or card readers ($49-59)

- Customer payment methods: Cards on file that took months to collect

- Financial history: Years of transaction data, tax records, and reporting

- Connected services: Payroll, team management, loyalty programs, gift cards

- Muscle memory: Staff trained on Square’s checkout flow

What switching to MoeGo Pay actually requires:

- New hardware purchases: $299-$499 per device for MoeGo-compatible readers

- Re-collecting every customer’s card: Industry benchmarks suggest 60-90 days to reach 70% card-on-file penetration with existing customers

- Staff retraining: New checkout flows, new refund processes, new end-of-day procedures

- Split financial history: Your reporting now lives in two systems permanently

- Processing fee evaluation: MoeGo Pay rates versus your existing Square rates (which may include negotiated discounts based on volume)

For a salon processing $15,000/month with 200 active clients, the conservative estimate for switching costs:

| Cost Category | Estimate |

|---|---|

| New hardware (2 devices) | $600-$1,000 |

| Staff time for retraining (8 hours × $20/hr × 3 staff) | $480 |

| Lost deposits during card re-collection (90 days) | $500-$1,500 |

| Administrative time for dual-system reconciliation | $300-$500 |

| Total switching cost | $1,880-$3,480 |

This doesn’t include the intangible cost: the friction created when you ask loyal customers to re-enter their payment information.

What Square-Committed Groomers Should Look For

If switching payment processors isn’t an option—because of hardware investment, customer card collection, or simply principle—you need grooming software built differently.

Evaluation criteria for Square dog grooming software:

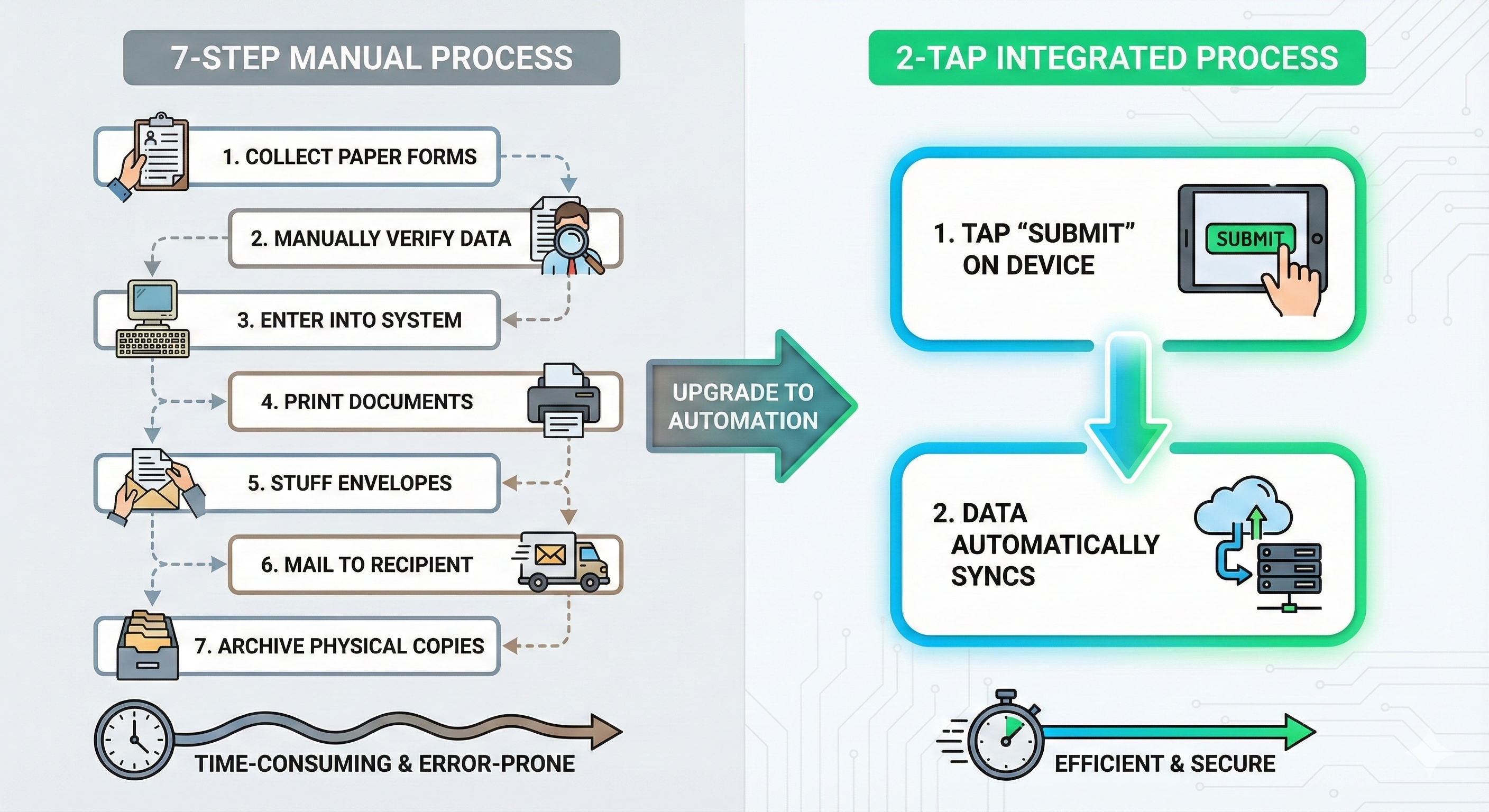

1. Native OAuth Integration

OAuth means you connect your own Square account directly. The software never touches your credentials. Transactions happen through Square’s infrastructure, not a middleman. This is the gold standard.

Red flag: Software that asks you to “export” transactions to Square or manually reconcile between systems.

2. Full Feature Parity Regardless of Payment Processor

Every feature—deposits, card-on-file, no-show fees, pre-authorization—should work identically whether you use Square, Stripe, or any other processor.

Red flag: “Premium” or “exclusive” features tied to a proprietary payment system.

3. Square Hardware Support

Your existing Square Terminal and Register should work. Period.

Red flag: Documentation that only mentions proprietary hardware or Stripe-branded devices.

4. No Competing Payment Product

If the software vendor operates their own payment processor, they have financial incentive to move you off Square. Their interests and yours are no longer aligned.

Red flag: Prominent “Switch to [Vendor] Pay” prompts throughout the interface.

Practical evaluation questions to ask:

- “Can I use my existing Square Terminal with your software?”

- “Are there any features I lose by not using your payment processor?”

- “How do deposits and card-on-file work with Square integration?”

- “Is your Square integration OAuth-based?”

If any answer is vague or qualified, that’s your signal.

Packyard: Built for Groomers Who Chose Square

Packyard exists specifically because this problem exists.

Native Square OAuth integration means you connect your own Square account in minutes. No credentials shared, no middleman processing. Your transactions flow through Square’s infrastructure exactly as they do today. Learn more about why native Square integration matters for grooming software.

Full feature access regardless of payment processor. Deposits, card-on-file, no-show fee collection, pre-authorization—all of it works through Square’s APIs. There’s no “Packyard Pay” competing for your transactions because we’re not in the payment processing business.

Square Terminal support for in-person payments. Your existing hardware works. No new devices required.

Payment processor agnostic architecture. Today it’s Square. The roadmap includes Clover and Stripe Connect for groomers who want options without software lock-in.

Built with real grooming industry experience. The founder’s wife owns a grooming salon with four years of operation and staff with 40+ combined years of grooming expertise. This isn’t venture capital building software for an industry they researched in a pitch deck.

Free Solo plan for independent groomers. Full scheduling, client management, and Square integration at no cost.

The Decision Framework

This isn’t about MoeGo being bad software. It’s about alignment.

If you’re comfortable switching to MoeGo Pay—or were already considering leaving Square—MoeGo remains a strong option with mature features and proven reliability.

If Square is non-negotiable for your business, you need software that treats Square as a first-class citizen, not a legacy integration being phased out.

Questions to answer:

- How much have you invested in Square hardware?

- How many customer cards are stored in Square?

- Are you willing to re-collect payment methods from your entire client base?

- Do you use Square’s connected services (payroll, loyalty, gift cards)?

- How important is consolidated financial reporting in one system?

If your answers point toward staying with Square, your software should too.

Next Steps

If you’re currently on MoeGo and concerned about Square support:

- Audit which features you’re actually using that require MoeGo Pay

- Calculate your switching costs using the framework above

- Document your Square hardware investment and customer card-on-file count

If you’re evaluating grooming software for a new business:

- Decide on your payment processor first, then choose software that fully supports it

- Avoid platforms with proprietary payment systems unless you’re committed to their ecosystem

If you’re ready to explore Square-native alternatives:

See how Packyard’s Square integration works with your existing hardware and payment setup, or explore complete grooming salon software that treats Square as a first-class citizen—not a legacy integration being phased out.

Try Packyard free today—connect your Square account in under 5 minutes with no credit card required, no payment processor switch, and no hardware replacement.

Packyard is all-in-one pet grooming software with native Square integration. Built by a team with direct grooming industry experience, Packyard handles scheduling, client management, payments, and communications—without forcing you off your existing payment infrastructure.